In elementary school science, we learn that humans need food, air and water to survive. Yet in reality, in our current modern society, without money, many of us would not even be able to get food and water. Beyond that, we would also like to have a safe, comfortable place to live in, clothes to wear, and the ability to seek medical help when necessary.

We need all the above, not only when we have the ability to generate income, but also after we retire from active income paying work. Therefore, it is important to save, while you have the ability to generate income, to save for rainy days that could appear in the form of a medical emergency, loss of job and when retirement comes around.

Why is it so Hard to Save Money?

Given our current culture of consumerism, we are constantly being bombarded with emotive advertising image to tell us what we should have (a bigger car, a bigger house, an exotic vacation) to create the “ideal” life, to make ourself happier. Such targeted advertising works by targeting our human tendency to want to fit in with our environment.

In the book “Switch – How to Change Things When Change is Hard”, the authors shared that

“People are incredibly sensitive to the environment and culture – to the norms and expectations of the communities they are in. We all want to wear the right clothes, say the right things and frequent the right places. Because we instinctively try to fit in with our peer group, behavior is contagious and sometimes in surprising way.”

This explains why we tend all similar habits and behavior among the people that you spend the most time with.

So while it’s easy to blame people for trying to keep up with the Joneses, sadly the game has been rigged to our disadvantage right from the start because because we are wired to do that subconsciously. It takes tremendous self-control and discipline to recognize how the game is played to our disadvantage to resist all these temptations that the world presents to us and to figure out what really makes us happy in life beyond all these material comforts.

Unfortunately, according to psychologists, self control is an exhaustible resource. To combat that, we need habits, and that is why we want our kids to learn how to save to have good money habits from young.

Why do we want our Kids to Learn How to Save?

The key idea here is forming a habit, a good habit, that is hopefully for life. Habits are actions that we do without really thinking about it because we have done it so often, it just sort of becomes second nature to us. We may not realize it, but our daily habits are what allow us to go through each day with relative ease, rather than have to make a decision for every second of the day.

One paper published by a Duke University researcher in 2006 found that more than 40 percent of the actions people performed each day weren’t actual decisions, but habits.

This is what happens when we teach our kids to brush their teeth twice a day. From young, we drill into them the habit of brushing in the morning and before bed. It becomes second nature to almost everyone, we spend two minutes brushing our teeth while thinking about what to wear and what to eat, we do not even particularly pay attention to the brushing motion, but we know we get the job done without much fuss.

Just as we want our kids to get into the habit of brushing their teeth to avoid cavities, we want them to get into the habit of saving or spending less than what they have to avoid financial troubles in their adult lives.

Just how exactly do we teach kids the habit of saving and living below our means?

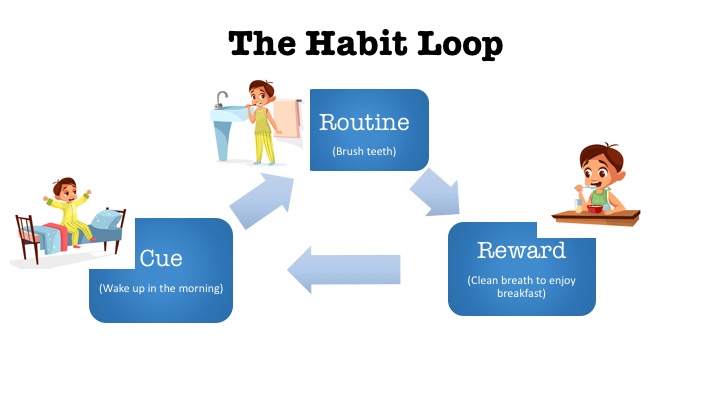

In the book “Power of Habits”, Charles Duhigg shares that habits are a cycle of cue, routine and reward. A cue or trigger (wake up in the morning), causes us to do a routine (brush teeth) which provide the rewards we crave (clean teeth and fresh breath). Furthermore, in all areas of our life, habits will form inevitably, and when it comes to money, we either spend without much thought or with a lot of thoughts.

Hence the goal is to teach the kids to spend money consciously. When they see something that they like (cue), they should not just mindlessly ask for it, instead they should think if this is something they really need or want, and if they want or need to get it, do they have the means to pay for it or are there cheaper alternatives (routine). The rewards will be the joy of obtaining something that they want if they can afford it or joy of saving her money because she realizes that she does not need it or does not really want it that badly. If there is something that she needs or wants but cannot afford it right now, then the motivation is to find ways to earn the money that she needs.

Habits for Life

Just as it takes efforts to build a good habit, it will also take effort to change a habit. In this case, it is our hope that our kids will be able to carry on this good habit to save and only spend what they have from young to adult life and avoid financial pitfalls in their life and have the ability to live financially responsible and fulfilling lives.